A point raised by the National Center for Education Statistics states that an average student’s decision on whether they want to attend college or not is entirely up to their family finances. The education expenses are the biggest concern for freshers, which puts them in a dilemma “Should I go to college or not”?

Providing college education to their children is still a utopia for many American families. College affordability is the most important yet scariest factor faced by these families when their child completes their high school graduation.

When making a decision about which college to attend, there are numerous factors to take into account, such as tuition fee, available courses, extracurricular activities, and more. However, many students find themselves stuck on the cost and perceive it as the primary determinant of their access to education.

Now, what can be done to eliminate the financial barrier to the path of acquiring an education? It appears that there may be a shortage of available resources to obtain accurate information regarding the diversity of universities, their tuition fee, and the process of applying for scholarships and grants at these universities.

Reasons for Hike in Education Expenses

According to the 2017 research report of College Board, tuition fee in colleges at four-year private and public colleges have increased by 36%.

Here are a few factors responsible for this problem of rising education costs, which are taking away the rights of students and making education a luxury.

- Rising Demand

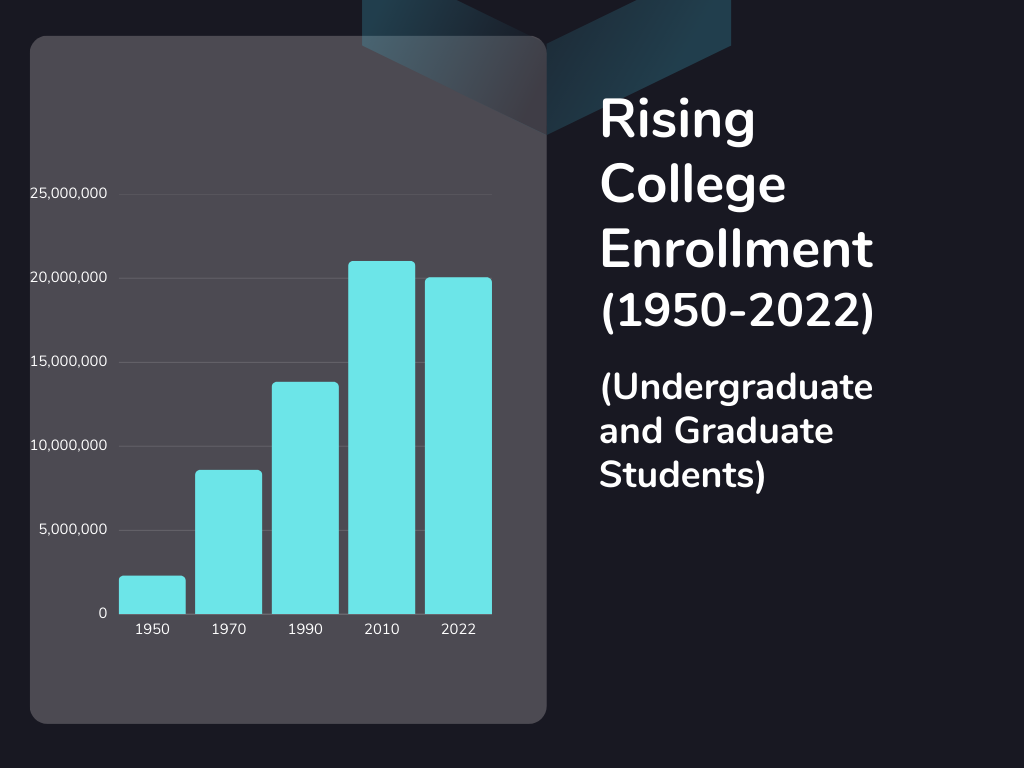

The cost of education and students enrolling into universities are two sides of the same coin.

According to the Education Data Initiative, enrollment peaked in the year 2010 at 21.02 million students. Since then, education has gotten more expensive, with tuition fee increasing every year.

Rise in Education Expenses are Associated with the Cycle of Demand and Supply

In the above graph, we can see a slight decrease in enrollment numbers in the year 2022. This is because of the shift in thinking of students, who are losing trust in college education.

Is a College Degree Worth It?

Our society is divided into two parts. One believes in the education system, and the other believes that it is a waste of money and effort. We have some really great examples of billionaires and geniuses who do not have a college degree.

Bill Gates dropped out of college at the age of 20 and made a revolutionizing company, “Microsoft”. Walt Disney ended his schooling in the 8th grade and moved on to open the world’s eyes to see animation at its best.

Today’s generation is inclining more toward becoming social media influencers, stock market traders, etc. They are finding it fun and a way to make money with minimal effort.

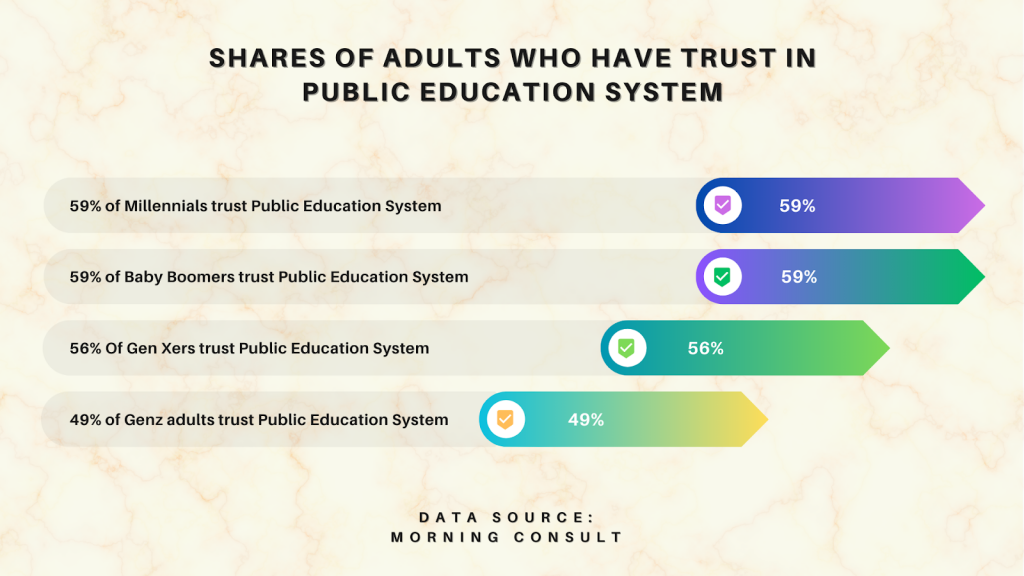

People Losing Trust in College Degrees

According to the data collected by Morning Consult, Gen Z has the lowest trust in the education system of public colleges or universities. They also revealed that in October 2020, 62% of adults supported the public education system, and now, as of May 2023, the numbers have decreased to 52.5%.

- Lower State Funding

Another reason for increased tuition fee is the decreasing financial support from the states. According to the data from the College Board, there is a correlation between the state’s funding and education costs. In the academic year 2015-16, the state’s funding was reduced by 11% as compared to the last 10 years, which is the result of a hike in education expenses.

Lack of State Funding Means the Burden of High Education Expenses Is Shifted to Students and Their Parents

At the same time, state funding is only related to public universities, as these colleges and universities are affiliated with the government. So, a reduction in state funding would have little impact on private universities but more on public universities and scholarships for college students.

- Operational Cost

Gone are the days when the things required to impart education were just different subject books, a professor, a blackboard, chalk, desks, and students. Now, the time has changed. Universities and colleges are no longer just institutions of learning and teaching. A classroom has become an e-classroom, with tablets on each and every desk.

Online learning is now the primary focus, with learning resources readily accessible on the internet, surpassing the significance of traditional learning methods.

High-Quality Education Comes With High Education Costs

Many institutions now have full facilities and services like healthcare, technological devices, counseling, research, dormitories, and institutional support. These facilities and services take a major chunk of money from the university’s budget, which in turn leads to skyrocketing tuition fee. Moreover, universities provide quality education, so they have to hire highly educated people, which means high salaries.

You may also like to read: Challenges in the Current US Education System

Student Loan Statistics 2023

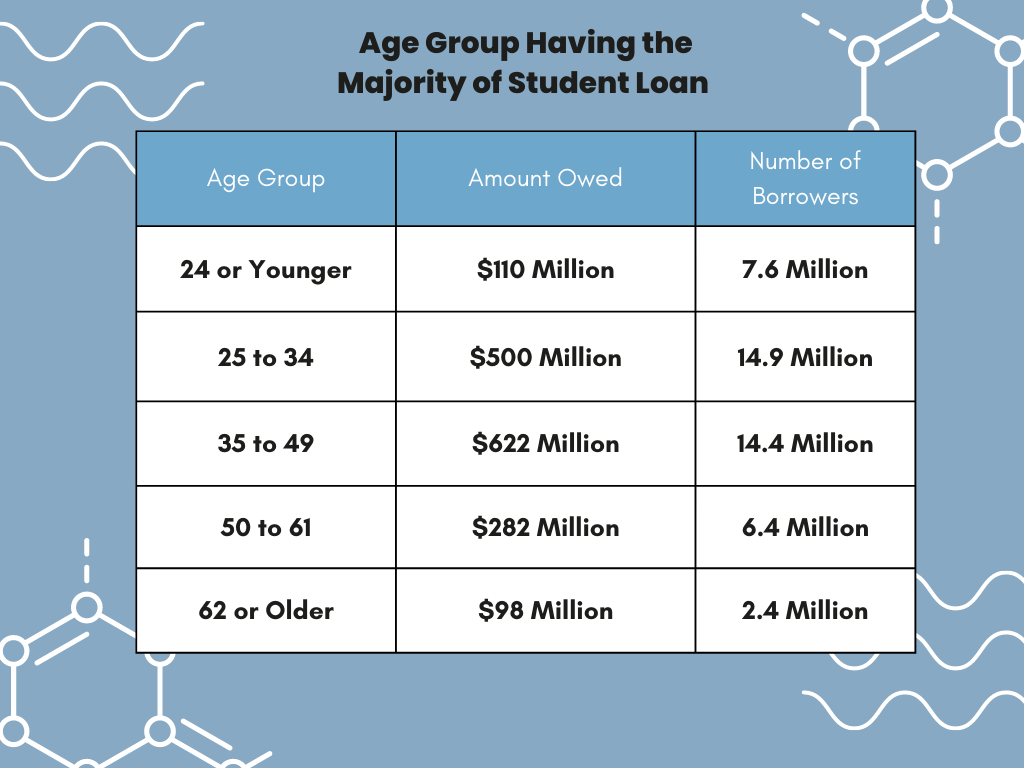

The ballooning education costs and student loans go hand in hand. According to Forbes Advisor, there is around $1.75 trillion student loan debt as of now, including federal and private loans. On average, one borrower owes $28,950. Moreover, 55% of public university students have educational debt, whereas 57% of private non-profit institution students take loans.

If we look at the statistics, student loan borrowers aged between 24 and 35 years owe around $500 billion to federal banks. Unfortunately, for some people, these loans do not leave the borrower’s side even after middle age. Not only this, people feel the pressure of repaying loans even after retirement.

Taking out a student loan is inevitable unless you have a scholarship or come from a financially strong family.

“Borrowing to pay for college used to be an exception; now it’s the rule.” – Arne Duncan, Formal United States Secretary of Education.

The Burden of Student Loan Remains With Individuals Even Beyond Their Retirement.

Federal Aid for Student Loan

In the year 2007, the Federal Government introduced the Public Service Loan Forgiveness Program (PSLF) under the act of College Cost and Reduction. Under the PSLF program, people who make 120 loan repayments while working for a non-profit organization or public service institution can get a portion of their student loans excused or forgiven.

According to the U.S. Department of Education, as of May 2023, more than 6,15,000 borrowers had successfully had their loans forgiven. PSLF has approved a total of $42 billion since October 2021.

The Public Service Loan Forgiveness Program is one of the most brilliant programs established by the government. It supports public employees, including professors, doctors, and policemen, as well as members of nonprofit organizations, by giving them relief from the headache of the installments of student loans.

How to Make Education Affordable?

In our January’s Industry Discussion, “How to Make Education Equitable and Affordable”, we got an amazing opportunity to invite and interact with brilliant speakers, Dr. Danny Barnes, Dr. Audrey Peek, and Lucas Kavlie.

Dr. Danny Barnes is a renowned Data Scientist and Cybersecurity Professor from Augusta University. Dr. Audrey Peek is a Senior Government Policy and Data Analyst from ACE University. Last but not least, Lucas Kavlie is a Vice President of Western Governors University.

All of these speakers made some really interesting points about how to make education affordable.

Dr. Danny Barnes. Dr. Audrey Peek, and Mr. Lucas Kavlie during an industry discussion co-hosted by Evelyn Learning’s CEO and Founder Praveen Tyagi and Content Analyst Tavleen Kour

Dr. Danny Barnes gave a great idea about opening a corporate education construct in a college where students can go to work as well as to classes. So, when they graduate, they’ll have a degree as well as work experience.

“A lot of problems are going around related to social-economic aspects, historical aspects, digital divide, etc. These problems are impacting the cost of education. There are two ways to overcome this situation. Schools should focus on e-books more which will help to cut down the cost of books from the cost of tuition. We can also guide students to take their early courses or generic courses at community colleges”.

On the other hand, Dr. Audrey Peek pointed out that there is an affordable college that’s right for every student. There are colleges that put students first and make sure they have minimal debt.

She advised everyone to use The Federal Government College Scorecard, which helps students to make their choice among the many options that fit their budget best.

“We have to help future students to avoid taking debt and struggling to repay it and that’s where we have to be innovative as well. The Federal Student Loan Program is broken and we need to fix it. There are some areas where a lot of improvement is needed like lowering student rate and improving student loan services. On the other hand, we want our states to increase funding to colleges or universities so that the education expense is reduced”.

Lucas Kavlie addressed that the problem of public relations is more than the problem with people being able to go to college, and there is always an ability to pursue tertiary or post-secondary education.

“When it comes to financial reasons, it should never be finance that eliminates somebody’s access to post secondary education. Individuals, who want money to attend colleges, there is money available but we’ve not done a good job of helping to guide them. We’ve figured out a way to reduce the tuition fee many decades ago in the United States by subsidizing primary and secondary education. But, tertiary and post secondary education are subsidized to a certain extent”.

Can We Afford Universities With Skyrocketing Education Costs?

How to Deal With the Problem of Cost of Education?

The increasing tuition costs and fees cannot be attributed to a single reason. There are a lot of factors that are responsible for this spiraling problem. Technological advancements, increasing inflation, reducing state funds, and certain economical challenges are causing this inevitable problem of the rising cost of education.

Now that we have somewhat understood the problem, it is important to find some backup plans and other options.

As said by Audrey Peek, students have to make their research game strong and find some colleges or universities providing scholarships, grants, or cheaper tuition fee. There is always an affordable college available for every student that fits right into their budget. Try finding resources online and gain as much information as you can.

According to Lucas Kavlie, there is always the ability to pursue education in a way that is either minimal or at no cost.

Also, if someone is ready enough to take a student loan, there are many schemes and programs started by the U.S. government to reduce the burden of repayment of loans. The information is out there, and you just have to grab it and seize the opportunity.

Lastly, a college degree is not the only criterion for judging whether a person will be successful in their career or not. If you’re interested in acting, singing, painting, designing, etc., you can make a career out of these fields too. You just need to be passionate about the career path that you’re choosing.